As business owners and working people, you know that wage and “take-home pay” are often very different after payroll tax. In the Netherlands, the average amount of take-home-pay from gross salary is only 70%. Expats often need to know — Where does that other 30% go to?

Proper management of employee wages is no simple task. Salaries are not just a number you and your employees determine before their start date: they involve complex calculations and expenses that are not immediately obvious to a payroll layman.

These complex calculations and requirements for compliance make payroll management a challenge, especially for growing businesses. Businesses that take care of managing their employee’s payroll themselves still must absorb the “costs for compliance” that generally come along with working in a country with strong employee protections.

It’s easier to conceptualize the costs of employment by considering an employee’s “take-home pay”. In this article, we’re going to break down the components of a Dutch worker’s salary, explain what these costs are about and whether the cost is paid by the employer or the employee.

The costs of labour include, not only wages and salaries paid to the employees, but also non-wage costs and social contributions payable by the employer.

Employee salary

Let’s start by breaking down the basic formula of an employee’s “take home pay“. The formula is as follows:

(Gross salary + 8% holiday allowance) = Net salary + payroll taxes

Gross salary

The most significant cost you will notice on any payslip is the actual salary amount. The salary generally communicated by employers is the gross amount. This is just “pure salary” and is the amount your payroll tax and social security contribution costs are based on.

Holiday allowance (vakantiegeld)

Employees in the Netherlands accrue entitlements to holiday allowance. The Dutch holiday allowance is a lump sum that accounts for at least 8% of the employee’s gross salary. This holiday entitlement is granted in May or June to the employee.

Payroll tax

As a business owner, you generally expect to pay tax on your employees. Many European countries have a reputation for significantly high payroll taxes, but this comes from the extensive government programs that make working life fair and appealing to workers.

This section is going to explore where exactly this payroll tax is going, and whether each cost is paid by you, the employer, or the employee via withheld wages.

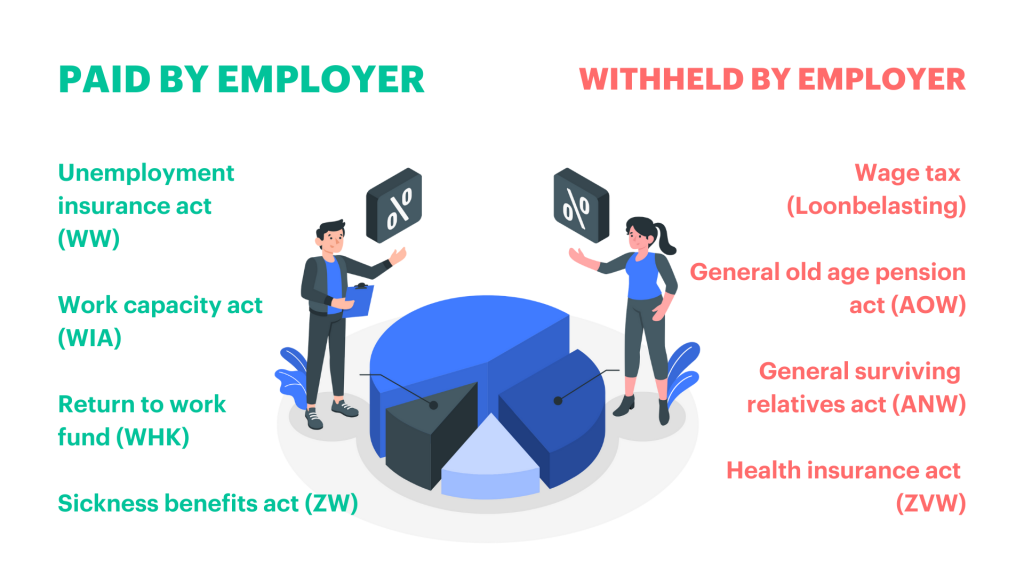

Contributions paid by employer

Business owners in the Netherlands are obliged to contribute an amount of social premiums with regard to the employee and national insurance contributions.

Unemployment insurance act (WW)

Employers pay the unemployment benefit (WW) contribution for employees. The tax rate of this contribution for employees with a fixed-term contract is lower than the contribution for employees with a flexible contract.

Work capacity act (WIA)

This act was created for those who have been disabled and out of work for more than 104 weeks. The benefit they receive will depend on whether they are deemed to be fully, partially, permanently or temporarily disabled, according to the inquiry carried out under this act.

Return to work fund (WHK)

This premium is paid by the employer to cover the costs of enabling the government to secure income for employees who are sick or disabled. The employer pays the differentiated premium for the Return to Work Fund (Whk), but may deduct part of the amount from the employee’s salary. If true, it would be stated in the payslip.

Sickness benefits act (ZW)

Based on this act, an employer is obligated to continue paying their employee a percentage of the salary for the first 104 weeks of sickness.

Expenses withheld from employee salary

The employer withholds wage tax and other social contributions from the employee’s earnings and pay to the Tax and Customs Administration (Belastingdienst).

Wage tax

Wage tax or wages withholding tax (‘Loonbelasting’) is an advance payment for the individual income tax.

General old age pension act (AOW)

AOW is the Dutch basic state pension. Everyone living and working in the Netherlands builds up this pension over the years, and will receive it back when he/she reaches the state pension age.

General surviving relatives act (ANW)

The purpose of this program is to support a working person’s family in the event of their death or severe incapacitation to work. In the event a working person dies or is declared only 45% capacity to work, the spouse or partner, and children under the age of 18 will receive payment.

Long-term care act (WLZ)

Long-term care is introduced as a general insurance for people who need support on a daily basis due to mental or physical limitations. The majority of people residing or working in the Netherlands is automatically insured under the Wlz scheme.

Health insurance act (ZVW)

Employees in the Netherlands must pay an income-related contribution for the health insurance premium. This premium accounts for a percentage of their income. Therefore, the employer will remit the ZVW contribution directly to the Health Insurance Fund.

Social security contributions

When comes time to determine the cost of an employee, it is not only the net wages that you have to consider, but also payroll taxes, social contributions, and other obligations. On average, employers should expect to spend a 50-65% premium on wage-related direct costs in addition to gross wages.

Accounted for in this premium include the majority of the robust social programs that benefit employees in the Netherlands. Including the national Unemployment Insurance Act, Work Capacity Act, Return to Work Fund, and Sickness Benefits Act.

Maternity pay

Pregnant employees are entitled to 4-6 weeks of maternity leave (pre-childbirth) and 10 weeks of maternity leave (post-childbirth). If the baby is born later than the due date, the leave begins after the actual birth and the total may therefore be longer than 16 weeks. If she is expecting multiple births that is extended to 20 weeks. During the leave period, the person is entitled to maternity pay of their full salary.

Employers can apply for a maternity allowance on behalf of their employee to the Employee Insurance Agency (UWV).

Sick pay

If you are an employer in the Netherlands and one of your employees falls ill, you are required to pay at least 70% of their last earned wages. You are obliged to do this for a maximum period of two years.

Care leave pay

In the Netherlands, employees are legally entitled to take (short-term) care leave to look after a sick relative such as a child, partner or parent. This type of leave is available on the condition that the employee is the only person who can provide such care.

Within a 12-month period, employees are entitled to take short-term care leave equal to twice their weekly working hours. During this time, the employer must pay at least 70% of their salary. For cases of life-threatening illness, long-term care leave is possible, but the employer is not obliged to pay any salary during this period.

Paid vacation days

Apart from holiday allowance, employees in the Netherlands are legally entitled to a minimum of 20 days (four weeks) of paid holiday leave per year, on the basis of a full-time job. This is based on a calculation of four times the number of hours worked per week.

Other expenses

All of the expenses and payments we identified earlier in this blog post are required costs in order to employ people in the Netherlands. If you want to offer a more competitive compensation package, consider implementing other benefits into your full package. Travel reimbursement, training courses, fitness allowance, and material gifts are just a few examples of benefits you can include for your employees. All of these examples are benefits businesses can offer tax-free or at a discounted rate.

Simplify your HR and payroll administration

Octagon Professionals is a full-service HR solutions provider with extensive experience facilitating payroll solutions for International businesses. If you are a growing or foreign business, Octagon Professionals can help you hire from abroad and ease your HR workload. If you’d like to learn more about how Octagon Professionals’ payroll solutions can benefit your business, schedule a consultation.

more news

Explained: The NEW 30% ruling

12-04-24

If you were recruited from outside the Netherlands, you are likely familiar with the concept of the ‘30% ruling.’ In 2024, the Dutch government introduced several key changes to the 30% ruling. To help businesses and expats understand what these changes mean for them, we are going to use this article to explain the NEW 30% ruling.

King’s Day: what you need to know

29-03-24

Spring has sprung, and the traditional Dutch holiday of ‘King’s Day’ is approaching! We celebrate King’s Day on April 27th, and you can be sure that the Dutch are already planning what they will be doing on this day. The ...